The Buy Low and Sell High All-Stars

Enjoy your hot starts (or dread your cold ones) while they last

An aspect of basketball that still seems poorly explained to me, at least on broadcasts, is the concept of shot variance. Here is what I mean: sometimes this wide-open shot from perhaps the best deep shooter in basketball does not go in.

Sometimes this, from a player who has attempted 41 shots at the rim this season and exactly two threes, goes in.

They are both wide open, but the average person obviously anticipates the shot from Koby Brea will go in far more often than the second shot from Troy’s Jerrell Bellamy. Sometimes, like in 2023-24, Purdue - 40%+ shooters from deep on the season - will shot 20% against Tennessee and 23% against Gonzaga. Or they’ll shoot 67% against Michigan. Sometimes, the worst high-major 3PT% team in the nation (Vanderbilt, 28.3%) will shoot 11-29 (38%) from deep to pull off a minor upset.

I think that more invested fans are at least a bit more conditioned these days to brace against shot variance in a single game. Statistically, we know that uber-hot or uber-cold starts will generally fade back to the mean, and games that don’t are considered outliers. This is not something people really enjoy believing in, because it goes against a bunch of sportswriter-y narratives people love, but I think attitudes have shifted a bit in recent years towards accepting this as part of the game. On certain nights, it is or isn’t your night.

What I don’t think has happened yet is the conditioning for bracing against shot variance over the course of a full month. Sometimes, over the course of half a season.

Over the last five full seasons (excluding 2020-21), a total of 67 teams have outshot their opponents from three by 10% or greater over the course of the first five weeks of the season. Generally, the teams involved have played anywhere from 7-10 games, so we think we know a lot about them. Maybe! But of those 67 teams, would you like to guess how many continued to outshoot opponents by 10% or more from three?

Well, the answer is two. Two teams, in the last five seasons, have managed to sustain their uber-hot starts from November/early December through March. Those are 3% odds that any of the seventeen teams to do it so far this year will continue to finish out these scalding starts. Considering the average output of these teams the rest of the way is a +1.2% 3PT% delta, you could see certain teams’ fortunes begin to take a serious step downward.

So! If you’re a fan of Bradley, Ohio State, North Dakota State, Rhode Island, Liberty, Coastal Carolina, Houston, DePaul, Montana State, Butler, Cincinnati, Northern Iowa, Kentucky, Tennessee, Murray State, Purdue, or Colorado, you have likely seen the best of your season so far, in terms of three-point differential. For instance, I think I am safe in doubting that Bradley will keep up an absurd +18.5% differential from deep when the greatest full-season differential of the last three seasons is +8.9%.

On the other hand, if you’re a fan of UMass, Stony Brook, San Diego, Northern Illinois, Coppin State, Jackson State, Penn, Portland State, Oakland, Ohio, Lindenwood, Northern Kentucky, Mississippi Valley State, Abilene Christian, or particularly poor Alabama A&M (-15.5%?!?), you’re due for good luck. Teams who’ve been outshot by 10% or more from deep since 2019 - 74 in total - have a 3PT% delta the rest of the way of -2.7%. Only two have sustained their uber-cold starts to finish sub-10%.

Here’s what this means: from mid-December onward, the in-game difference between the hottest teams of the first five weeks of a given season and the coldest, given 25 three-point attempts, is exactly one made shot. Three points. That’s it! Based on these first five weeks alone, you’d expect Bradley to make eight more threes in this sample than Alabama A&M, or a 24-point differential. On average: not the case.

The reason 3PT% differential, and by extension eFG%, matters most is because it statistically correlates with a drop or rise in overall performance at a rate almost double of any other stat. In fact, the closest to 3PT% is 2PT%, which means that most of a team’s rise or fall in performance is driven by making or missing shots. Who would’ve guessed that, in a game where points are measured by made shots, it would be meaningful to make shots?

The point is more that there’s a better way to measure who these 3PT% boons, and busts, will benefit. Given that schedule-adjusted TO% and OREB% are actually quite stable from the first month of the season to the last (I measured about 10-20% variance in an average season versus almost 50% for 3PT%), teams who are doing well in terms of producing positive turnover and offensive rebound margins can make up for lost 3PT% production by simply getting more shots. Teams that don’t do that thing could be in trouble.

I have a formula. Sort of. Presenting the Schedule-Adjusted Shot Volume Index, which eliminates 3PT% from the conversation, adds Free Throw Rate, but keeps 2PT% around as a metric that’s twice as stable as 3PT% and nearly as stable long-term as TO%/OREB%. All of the numbers are weighted appropriately versus what I’ve found to be accurate correlation-wise. If you were to blend the SASVI with the actual team ratings as of now, you’d get a top five of (in order) Auburn, Duke, Tennessee, Iowa State, and Alabama. I think that’s reasonable.

The more fun part is spotting the outliers. Which teams are best positioned to rebound from a cold(er) shooting start thanks to high-end shot volume? Which teams should be worried about sustaining their starts because they can’t sustain their shots? These are my picks for the 2024-25 Buy Low, Sell High All-Stars.

Normally these are paid, but because this is two days late, I’m making it free as an apology. Enjoy!

The Buy Low All-Stars

Arizona. Boy, is this going to be a normal conversation about a normal team! Arizona is 4-4, went 1-2 in a preseason tournament, got beaten at home by Duke, and got smoked on the road by a fine but not great Wisconsin team. They have a huge hole to dig themselves out of, starting with a neutral-ish game coming on Saturday against UCLA.

I fully believe they can do it. If you were to sort the SA-SVI by purely that and not the blended numbers with overall efficiency, Arizona ranks #3 in the nation. I buy it. Against a top-40 schedule, they’ve posted a +9.8% 2PT, +13.9% OREB%, and a +4.2 turnover margin per 100. They consistently win the 2PT% battle (7 of 8), OREB% (6 of 8), and TO% (6 of 8). Why are they 4-4? In four losses, they’ve been outshot from three 39%-25%. I don’t think this can, or will, last. Third-best is a stretch but if they’re secretly the 13th-best team in the sport, would anyone be that surprised?

UConn. Going 0-3 in Maui was a move the average person would describe as “not ideal” for the Huskies, but a closer inspection reveals the Huskies giving up 55%, 56%, and 47% hit rates from three in a three-game sample. I’ll safely say that won’t happen all year long. UConn has one of the biggest 2PT% deltas in the sport and remains dominant on the boards. Do I think they’re as good as they were last year? No. Do I think they’re a plausible low-end top-10 team? Yeah, why not.

Vanderbilt. This is the second-most oddball pick on the list for me, mostly because you could argue the time to buy low on Vandy was a month ago. The Dores are 9-1, up 35 spots from preseason in KenPom, and own wins over Nevada and TCU. They’re quite obviously a good team. They’ve also been a good team despite getting outshot by 7.5% from three. Vandy owns a +8.7 turnover margin per 100 and a +15.2% 2PT% delta. While the latter won’t hold, I’d make an honest argument that this is a top-50, possibly top-40 team lurking in the 60th-place team’s body. A Tournament bid is absolutely reasonable.

Louisville. Meanwhile, there hasn’t been a better time to buy low on these guys. Louisville had to escape UTEP at home, got blown out by an Ole Miss team I would grade out as “fine” last week, and is 6-4 with multiple season-ending injuries to their roster. And yet. The Cards are shooting just 27% from three, which is 8% below what would be expected based on the careers of their available roster members. They’re #13 in 2PT% and #341 in 3PT%. That’s not gonna last. Also, they have a combined OREB/TO margin of +10.4 per 100 possessions and take seven more free throws per game than opponents. An average Louisville possession results in everyone but the shooter crashing the boards.

In the blended efficiency/SA-SVI ratings, they’re a top-30 team.

Idaho State. There is no odder oddball pick than this. Idaho State is a completely anonymous Big Sky team that is 4-5 (2-5 versus D1) and is not considered one of even the four best teams in the conference by the average observer. But! I have a point here.

For one, Idaho State is already up 85 spots (314 → 229) from their preseason KenPom ranking. They’re clearly pretty decent. They have also done this despite posting one of the worst three-point deltas in the sport: -8.3%. This matters because the Bengals are an astonishing +17.1% in OREB differential, are only -1.5% in 2PT% against a top-75 schedule, and somewhat quietly grade out as a top-150 team in the sport in these blended ratings I’ve created. Keep an eye on these guys; if 3PT% ever goes their way, you may see the Bengals in the Big Dance for the first time since 1987.

Honorable mentions: Baylor, BYU, and Michigan State. All teams that are somewhere around 5-10 spots lower than is implied based on an average 3PT% differential. MSU in particular is notable to me; in a wide-open Big Ten they could absolutely steal the crown. I’ve got them #17, the third-highest Big Ten team behind Illinois and Maryland.

The Sell High All-Stars

Purdue. This makes me nauseous. Do you think I WANT to doubt Matt Painter? I absolutely do not want to do such a thing. The problem is not Painter; the problem may just be that this roster seems to be built on unsustainable numbers, based on the play so far. Through 10 games, Purdue has a negative turnover margin of -2.1 per 100 possessions, is barely above water in OREB% (+0.8%), and sits at a +3.9% 2PT% delta, albeit against the nation’s 13th-toughest schedule.

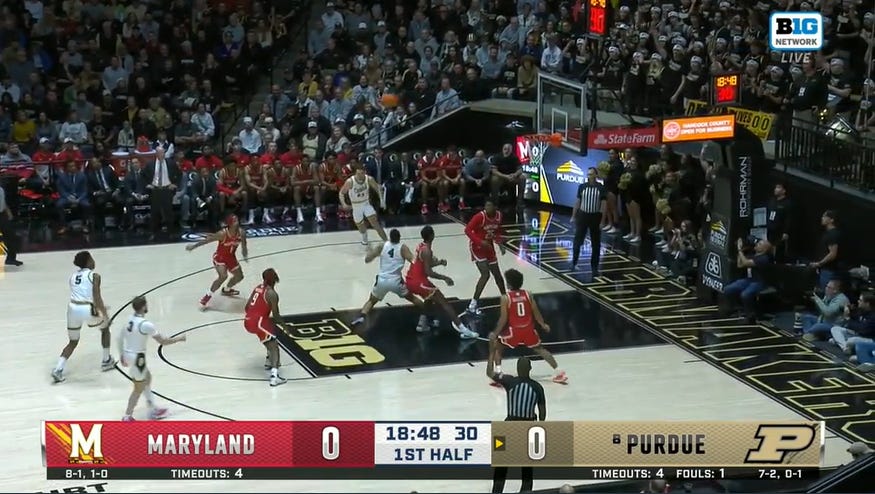

So: how are they 8-2? Well, they’re shooting 41% from three while opponents are at 31%. Pretty simple. What’s helped is that in their four true either/or games (92-84 over Yale, 87-78 over Alabama, 80-78 over Ole Miss, 83-78 over Maryland), they’ve shot 39-87 (45%) from three. Opponents: 42-117 (36%). That’s still good, but shooting 45% from deep in coin-flip games…uh, yes, you don’t need me to tell you that’s sustainable.

The problem is that if this favorable 3PT gap does go away, which it may, Purdue hasn’t shown much in the way of generating shot attempts to make up for that. Boilermaker opponents actually have a higher shot volume than Purdue. Purdue’s actually playing like it did in the mid-2010s, when it had poor TO% numbers and a lack of elite rebounding to make up for it. Some of this is Edey-driven, but considering Purdue had one of the best OREB% margins in modern history in 2015-16, you can’t handwave it away by saying “we don’t have Edey.” The average Purdue possession looking this light on the boards is unusual.

If Purdue can’t get better at rebounding or find some interior defense, I’m alarmed at what they might actually be. Last year, through the first five weeks, Kansas was ranked 18th in Torvik despite posting a +13.9% eFG% differential on their opponents. They were -1.6% in TO% and just +0.6% in OREB%. Thanks to a 7-4 record in close games, they got a 4 seed…and still went 10-8 in conference play, getting demolished in both the conference and NCAA Tournaments. This Big Ten is more wide-open than last year’s Big 12, but I’m worried about the preseason top contender for the crown.

Ohio State. I appreciate when a case is overly simple. Ohio State has a +14.3% 3PT% delta and doesn’t have elite shot volume metrics to make up for it. I think they’ll actually be generally fine, but the brief hope people had of them being a top-15 or top-20 team should be gone. This is a First Four team, maybe.

Memphis. They had such a good Maui Invitational! They beat UConn AND Michigan State. Certainly, this will be the year a Memphis team makes it to March without a completely inexplicable—

Ah. My bad. Memphis is shooting 44% - FORTY FOUR PERCENT - from three. They’re losing both the turnover battle and the offensive rebound battle in season-long numbers. They’ve been outshot from two. I believe the Arkansas State result is more than just a blip.

Bradley. The most open-and-shut case of all-time: a +18.5% 3PT% delta and the #1 eFG% in America at 61.2%. Neither will hold, though I will note Bradley does quite well on 2PT% both ways. I’d still pick Drake to win the league.

Oklahoma. The Sooners are a rare breed: a 9-0 team with multiple good wins that’s actually fallen from their preseason rankings at KenPom and Torvik. The reason here is pretty obvious. Oklahoma has a +7.9% 3PT% in their favor, which isn’t nuts on its face, but they’re getting outrebounded by a very weak schedule, are just +4.3% on 2PT% with the 239th-best 2PT% allowed, and have had to produce timely escapes against some remarkably poor opponents. Northwestern State led these guys with 13 minutes to play. I just don’t buy it.

Honorable mentions: Wisconsin, Kentucky…and Kansas. These are three teams with varying cases that don’t quite meet my criteria for a hard fall. Wisconsin has experienced a +5.2% 3PT% so far but has a good turnover margin and gets to the line frequently. Kentucky is not going to experience opponents shooting 26.3% from deep for the entire season, but they come out very well on the boards like last year’s BYU team. Kansas isn’t that impressive in any one category, and based on career numbers, their 35% hit rate from deep probably won’t hold. But they still grade out as one of the 15-20 best teams or so, so it’s not that bad.